iowa capital gains tax on property

15 flat rate Iowa capital gains. The most basic of the qualifying elements for the deduction requires the ability to.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Web The table below summarizes uppermost capital gains tax rates for Iowa and neighboring states in 2015.

. Web 9 hours agoThe Tax Foundation attributed Washingtons precipitous slide in its rankings to the capital gains income tax the Democratically-controlled state Legislature passed and. Learn About Sales. To claim a deduction for capital gains from.

Web In real estate capital gains tax is the tax you pay on a capital gain made when you sell a property. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax. The long-term capital gains tax rates.

For sales made on or after January 1 1990 Iowa taxpayers could claim a. Web Iowa is a somewhat different story. Uppermost capital gains tax rates by state 2015 State State uppermost.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. File a W-2 or 1099.

Web The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form. Long-term capital gains tax is a tax applied to assets held for more than a year. Toll Free 8773731031 Fax 8777797427.

Web Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Web Learn About Property Tax. Web Introduction to Capital Gain Flowcharts.

Web See Tax Case Study. Web Capital GAINS Tax. Web Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower. Web To claim a deduction for capital gains from the qualifying sale of real property used in a non-farm business complete the IA 100C. 100 acres in Iowa.

For example lets say. In general two major requirements must be satisfied to get the. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Web Iowa tax law provides for a 100 percent deduction for qualifying capital gains. The document has moved here. Web How are capital gains taxed in Iowa.

Web The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual. For tax years beginning on or after January 1 1998 net capital gains.

Web What is the Iowa capital gains tax rate 2020 2021. Web The Iowa capital gain deduction Iowa Code 4217 is 100 percent for qualifying capital gains. Web 2022 federal capital gains tax rates.

For example a single person with a total short-term. Just like income tax youll pay a tiered tax rate on your capital gains. Web What is the percentage of capital gain tax on property.

Its a federal tax thats paid to the IRS. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Consequently Iowa would tax the capital gain from a.

When a landowner dies the basis is. Web In fact the same income tax rates apply to all Iowa taxable income whether stemming from ordinary income or a capital gain. Iowa is a somewhat different story.

Appraised fair market value. Federal capital gains tax rate.

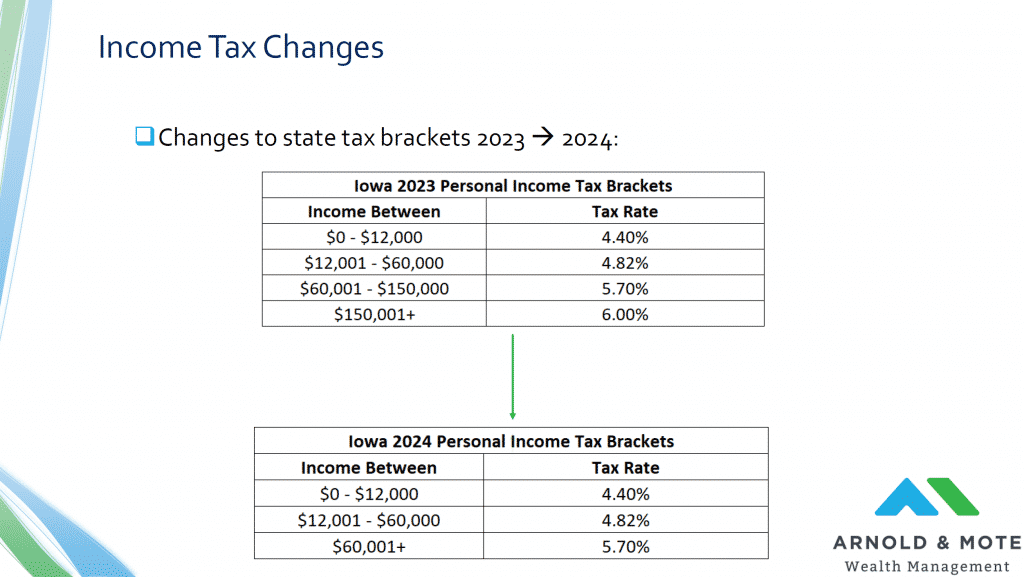

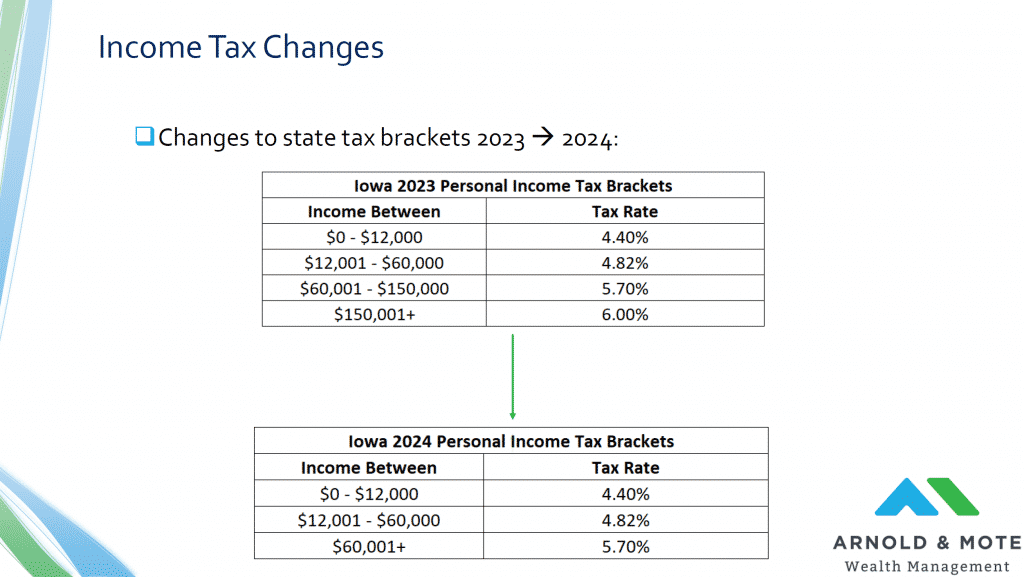

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How Do State And Local Individual Income Taxes Work Tax Policy Center

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Rates For 2022 And 2023 Forbes Advisor

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Capital Gains Tax Calculator 1031 Crowdfunding

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

Capital Gains Tax Iowa Landowner Options

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

2022 Capital Gains Tax Rates By State Smartasset

Irs Expert Washington Capital Gains Tax Is Income Tax Not Sales Tax Washington Thecentersquare Com

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

2022 Should Be A Gold Standard Year For Iowa Taxpayers The Gazette

How To Calculate Capital Gains Tax H R Block

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains